How Hard Money Atlanta can Save You Time, Stress, and Money.

Wiki Article

The Basic Principles Of Hard Money Atlanta

Table of ContentsHard Money Atlanta - Questions9 Easy Facts About Hard Money Atlanta ExplainedThe Greatest Guide To Hard Money AtlantaLittle Known Facts About Hard Money Atlanta.

Given that hard cash finances are collateral based, also understood as asset-based loans, they call for very little paperwork and allow capitalists to shut in a matter of days. However, these finances come with even more risk to the loan provider, and also therefore require greater deposits and also have higher passion rates than a traditional funding.Lots of traditional car loans may take one to 2 months to shut, but difficult money financings can be shut in a few days.

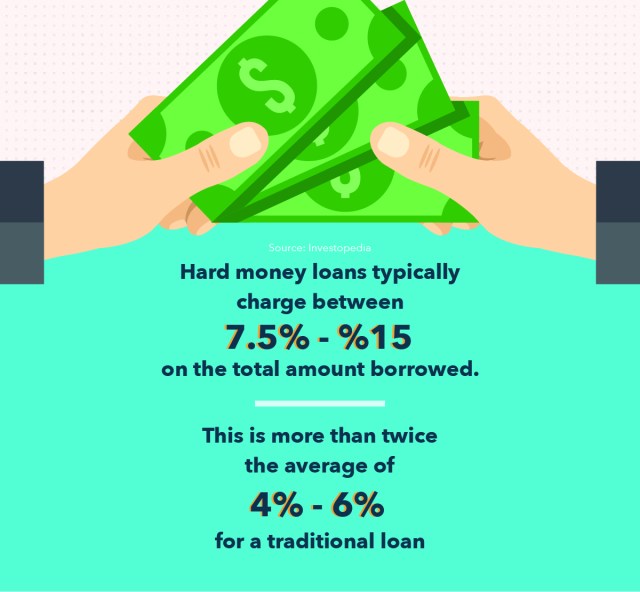

Standard mortgages, in comparison, have 15 or 30-year repayment terms on average. Tough cash finances have high-interest prices. The majority of tough cash lending interest rates are anywhere in between 9% to 15%, which is considerably higher than the rate of interest rate you can anticipate for a conventional mortgage.

Once the term sheet is signed, the funding will certainly be sent to handling. Throughout car loan handling, the lending institution will request files and also prepare the car loan for final car loan review as well as routine the closing.

Not known Factual Statements About Hard Money Atlanta

You'll require some funding upfront to get a tough money finance as well as the physical property to function as collateral. This can make tough money fundings unattainable for some financiers or homeowner. In addition, hard money fundings normally have higher rate of interest than standard mortgages. They are additionally interest-only financings which implies your regular monthly repayment just covers interest and the major quantity will schedule at maturation as a round figure.

Usual leave strategies consist of: Refinancing Sale of the asset Payout from other source There are lots of scenarios where it might be helpful to use a tough money car loan. For starters, genuine estate financiers who such as to house flip that is, acquire a rundown home in requirement of a great deal of work, do the work try these out directly or with contractors to make it a lot more useful, after that reverse and also sell it for a greater rate than they purchased for may find hard cash financings to be ideal funding options.

Because of this, they do not require a lengthy term as well as can stay clear of paying also much interest. If you purchase financial investment residential properties, such as rental properties, you may also locate tough money fundings to be excellent options.

The 10-Second Trick For Hard Money Atlanta

In some cases, you can likewise use a tough money lending to purchase uninhabited land. This is an excellent option for designers that remain in the procedure of certifying for a building funding. hard money atlanta. Keep in mind that, even in the above scenarios, the possible drawbacks of hard money fundings still apply. You have to make certain you can settle a tough cash finance before taking it out.If the expression "hard money" motivates you to begin pricing estimate lines from your favored gangster flick, we wouldn't be stunned. While these kinds of financings might appear challenging and also daunting, they are a typically utilized funding method numerous actual estate capitalists make use of. What are difficult money car loans, as well as just how do they function? We'll clarify all that and extra below.

Difficult cash loans usually include higher rates of interest and also shorter repayment routines. Why choose a hard money finance over a traditional one? To answer that, we ought to first take into consideration the benefits as well as downsides of difficult money finances. Like every economic tool, difficult money finances come with benefits and disadvantages.

The smart Trick of Hard Money Atlanta That Nobody is Discussing

In addition, since personal people or non-institutional lenders provide hard cash fundings, they are not subject to the very same regulations as conventional lenders, that make them extra risky for borrowers. Whether a difficult money loan is appropriate for you depends on your situation. Difficult money financings are excellent options if you were denied a traditional loan and also need non-traditional funding., we're right here to aid. Obtain started today!

The application process will usually entail an assessment of the residential property's worth as well as potential. In this way, if you can not manage your repayments, the difficult cash lender will merely relocate ahead with marketing the residential or commercial property to recoup its investment. Difficult cash lenders normally bill higher internet rate of interest prices than you 'd carry a traditional loan, yet they likewise money their car loans faster as well as generally call for much less documentation.

Rather than having 15 to thirty years to repay the car loan, you'll typically have simply one to five years. Hard cash finances function quite differently than conventional finances so it is very important to recognize their terms and also what transactions they can be utilized for. Hard money loans are generally planned for financial investment homes.

Report this wiki page